BUSINESS & ECONOMY

As December hangovers sink gradually, many of us once again find ourselves entangled in pennilessness and the simmering 'Njaanuary' heat after a marathon money-spending spree during the just ended festive season.By Ndung'u Wa Gathua.

The situation is further complicated by the fact that the end of 'Njaanuary' when one can expect to break from the biting financial situation seems to be 100 days away. As such, the options apparently become limited leading to some of us resorting to desperate 'okoa jahazi' measures in order to continue surviving.

Some of these miserable measures include but not limited to, disposing valuable household items at throwaway prices or seeking short-term loans from local Shylocks at exorbitant interest rates after surrendering vital document(s) or item(s) that serve as loan security.

While these might be the only available options available for you, here we will help you to avoid resorting to such hopeless actions that may end up earning you more pain than gain.

In this digital era, you for instance, need not subject yourself to the sharp and unforgiving claws of local Shylocks when all you need to do is use your mobile phone to secure a loan that is enough to dismantle all your choking 'Njaanuary' financial woes.

Now, sit back and relax I explain to you how you can secure a loan of your choice from two mobile phone loan apps and within a matter of minutes, you shall have your loan amount disbursed in your M-Pesa account. Sounds pretty nice? Good! 'Njaanuary' is all about helping a brother or a sister in a thick fix. Isn't it?

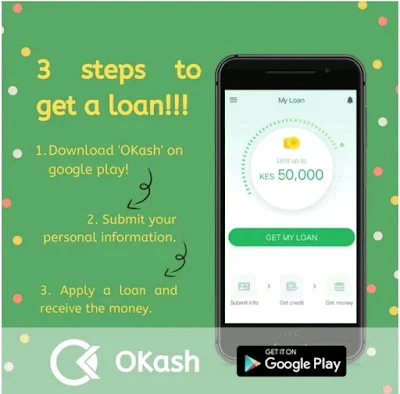

a. OKash mobile loan app

With OKash, all you need to do is to follow these 3 super-quick steps;

1. Download OKash app on Google Play Store or click here to download.

2. Apply for a loan.

3. Receive your loan.

But why choose OKash over any other money-lending app you may have heard about or even come across?

1. High loan amount: Loan amounts up to Sh50K

2. Fast disbursement: You get your loan in less than two minutes

3. Advanced credit scoring system: Your application will be processed in minutes with no documentations.

b. OPesa mobile loan app

OPesa is yet another reliable loan app currently in the Kenyan market where you can obtain a loan within minutes and prove to 'Njaanuary' that indeed Devil is liar.

Here is how to download and install OPesa loan app in your mobile phone and apply for a loan;

-Open Google Play Store or click here to go to play store directly.

-Search, download and install OPesa app.

-Open your loan app and register using your Safaricom number.

-Fill in the form provided by answering a few personal questions and kaboom! You are good to go!